September 6, 2018

Seeing Contributions More Clearly

Accounting for contributions and grants by nonprofits requires judgment and interpretation of guidance that has led to diversity in practice among similar organizations. To reduce that diversity, assist in evaluating whether a transaction is a contribution (nonreciprocal) or an exchange transaction (reciprocal), and provide insight into accounting for conditional contributions, the FASB issued Accounting Standards Update (ASU) 2018-08, Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made, in June 2018. This guidance is the result of questions the FASB received regarding ASU 2014-09, Revenue from Contracts with Customers (Topic 606), as to whether nonprofit grants should be considered contracts with customers (within the scope of ASU 2014-09) or contributions.

Evaluating Transactions

When evaluating a transaction, the first step is determining whether each party receives commensurate value and is reciprocal. If yes, it is accounted for as an exchange transaction under ASU 2014-09. However, ASU 2018-08 specifically highlights the benefits received by the general public and any positive sentiment received as a result of supporting the mission of an organization does not qualify as commensurate value. If the transaction is not reciprocal, it is a contribution accounted for under ASU 2018-08.

Contributions are evaluated to determine whether donor-imposed restrictions exist, which drive when revenue is recognized by the recipient and expenses recorded by the provider. A contribution is conditional when there is:

- A barrier that must be overcome AND

- Either a right of return of assets transferred or a right of release of a promisor‘s obligation to transfer assets.

The following indicators should be considered when determining if a barrier exists that must be overcome. However, no single indicator is determinative as some indicators may be more significant than others when evaluating the agreement.

- A measurable performance-related or other measurable barrier (e.g. assets are transferred to the recipient when a certain level of service as measured by an identified number of units of output is achieved or upon the occurrence of a specific event)

- Limited discretion by the recipient on how the resources are used (e.g. following specific guidelines about qualifying allowable expenses, using certain personnel, or following a specific protocol)

- Whether a stipulation relates to the purpose of the agreement, which generally excludes administrative tasks and trivial stipulations (e.g., producing an annual report to confirm the transferred assets were used in accordance with the contribution agreement is a common requirement unrelated to the underlying purpose of the agreement as it is administrative in nature)

When donor stipulations are ambiguous, they are considered conditional when they contain stipulations that are not clearly unconditional. Recipients of conditional promises to give are required to comply with current GAAP requirements for timing of revenue recognition. Additionally, if a contribution is received in advance of the conditions being met, a liability is recognized.

If a contribution or promise to give is unconditional, the organization should consider whether the contribution is restricted under the current definition of “donor-imposed restriction”, which includes consideration of the purpose and time period available for use.

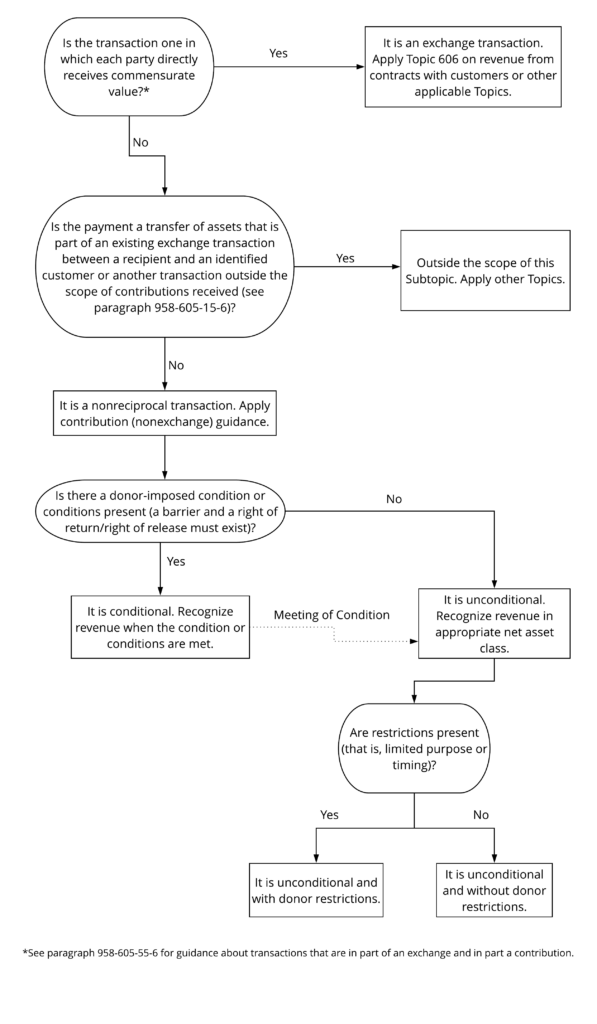

Decision Tree

ASU 2018-08 contains the following decision tree to help recipients determine the proper accounting for transferred assets.*

Application Guidance

The guidance should be applied on a modified prospective basis in the first set of financial statements following the adoption or effective date. The amendments should be applied to agreements that are not completed as of the effective date or entered into after the effective date. Prior-period results should not be restated and no cumulative-effect adjustment should be recorded.

Effective Date

The ASU is effective for non-public resource recipients for annual periods beginning after 12-15-18, and interim periods within annual periods beginning after 12-15-19. The ASU is effective for non-public resource providers for annual periods beginning after 12-15-19, and interim periods within annual periods beginning after 12-15-20.

See ASU 2018-08 for a complete summary of the changes and for practical application examples.

If you have any questions about this new standard, contact the Johnson Lambert team.