May 24, 2023

Will IRS Designate 831B Captives as Listed Transactions?

The Treasury Department and Internal Revenue Service recently issued proposed regulations IR-2023-74. The proposed regulations clarify what it means to be a transaction of interest, and include parameters where a micro-captive may now be considered a listed transaction. The IRS defines a micro-captive as a nonlife insurance company that has made an election to be taxed under §831(b), in lieu of the tax imposed under §831(a).

A transaction of interest is a transaction that the IRS believes to have the potential to be tax avoidance or evasive and for which it is monitoring fact patterns.

In the proposed regulations, the IRS went one step further and deemed certain micro-captives as listed transactions.

A listed transaction is a transaction that is the same as or substantially similar to one of the types of transactions that the IRS has determined to be tax avoidance. The IRS provides that participants and material advisors in these transactions are required to disclose each reportable transaction on Form 8886 and are subject to penalties if there is failure to disclose.

The proposed regulations are in response to Notice 2016-66. Notice 2016-66 was released by the IRS on November 1, 2016 and identified certain micro-captive transactions as transactions of interest. The Notice designated micro-captives as a transaction of interest if they had either a loss ratio of less than 70% or made financing available directly or indirectly to an insured, or a person related to an insured, at any time in the most recent five taxable years. A recent ruling in the Sixth Circuit determined that the IRS lacks authority to identify transactions of interest and listed transactions by notice (rendering Notice 2016-66 invalid), and must instead identify such transactions by following the notice and public comments period that apply to regulations.

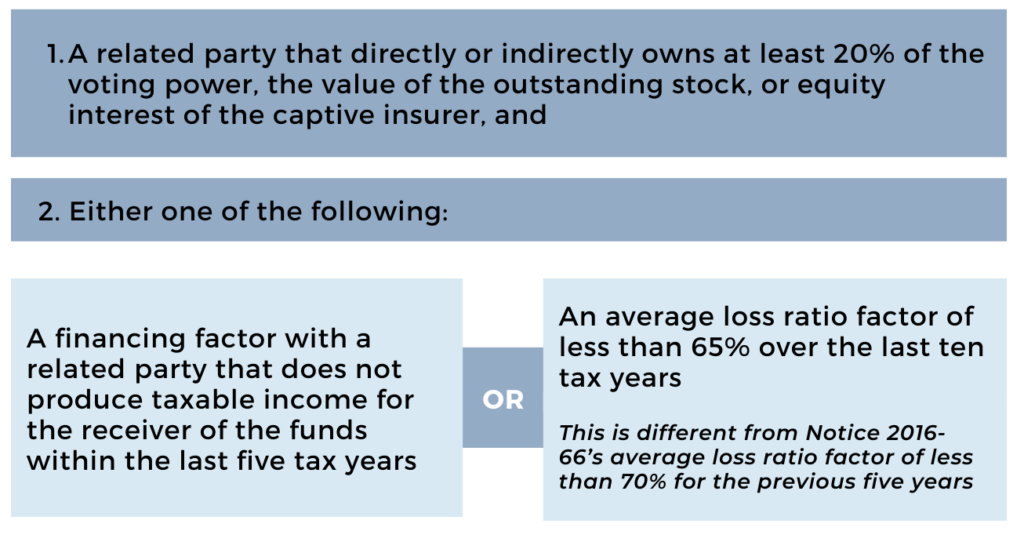

The proposed regulations identify two categories of micro-captive as listed transactions. Each one of these categories involves a captive insurer and a related party. For a micro-captive to be a listed transaction it must have:

Additionally, the proposed regulations clarify that micro-captives that provide Consumer Coverage reinsurance arrangements, (i.e. third party risk) are excluded from being treated as a listed transaction or transaction of interest. The IRS determined that this arrangement is appropriate as long as the provided commission paid for the Consumer Coverage is comparable to the commissions paid for Consumer Coverage that is not issued by the captive.

All comments are due to the IRS by June 12, 2023, and a public hearing in regards to these regulations is scheduled for July 19, 2023 at 10 a.m. While Notice 2016-66 is obsolete, once the proposed regulations are final, taxpayers will have 90 days to file an updated Form 8886 disclosing the listed transaction in order to comply with the new regulations.

To read the full IRS press release: IR-2023-74.

If your captive will fall into one of these listed transactions, please reach out to your Johnson Lambert tax team to discuss.

Disclaimer

The content contained herein is provided solely for educational purposes to Johnson Lambert LLP’s intended audience, and should not be relied upon as accounting, tax, or business advice because it does not take into account any specific organization’s facts and circumstances.