February 11, 2021

A Second Chance: What Insurers Need to Know About PPP Round 2

Round 2 of the Paycheck Protection Program (PPP Round 2) loans, part of The Economic Aid Act (the Act), was passed in December. Eligibility for PPP Round 2 loans, up to $2 million, is for small businesses that have:

- No more than 300 employees

- Used or will use the full amount of the original PPP loan on or before the expected date of Round 2 PPP loan being received

- A 25% or more reduction in gross revenues on all or part of comparable quarters in 2019 and 2020

Eligible Expenses

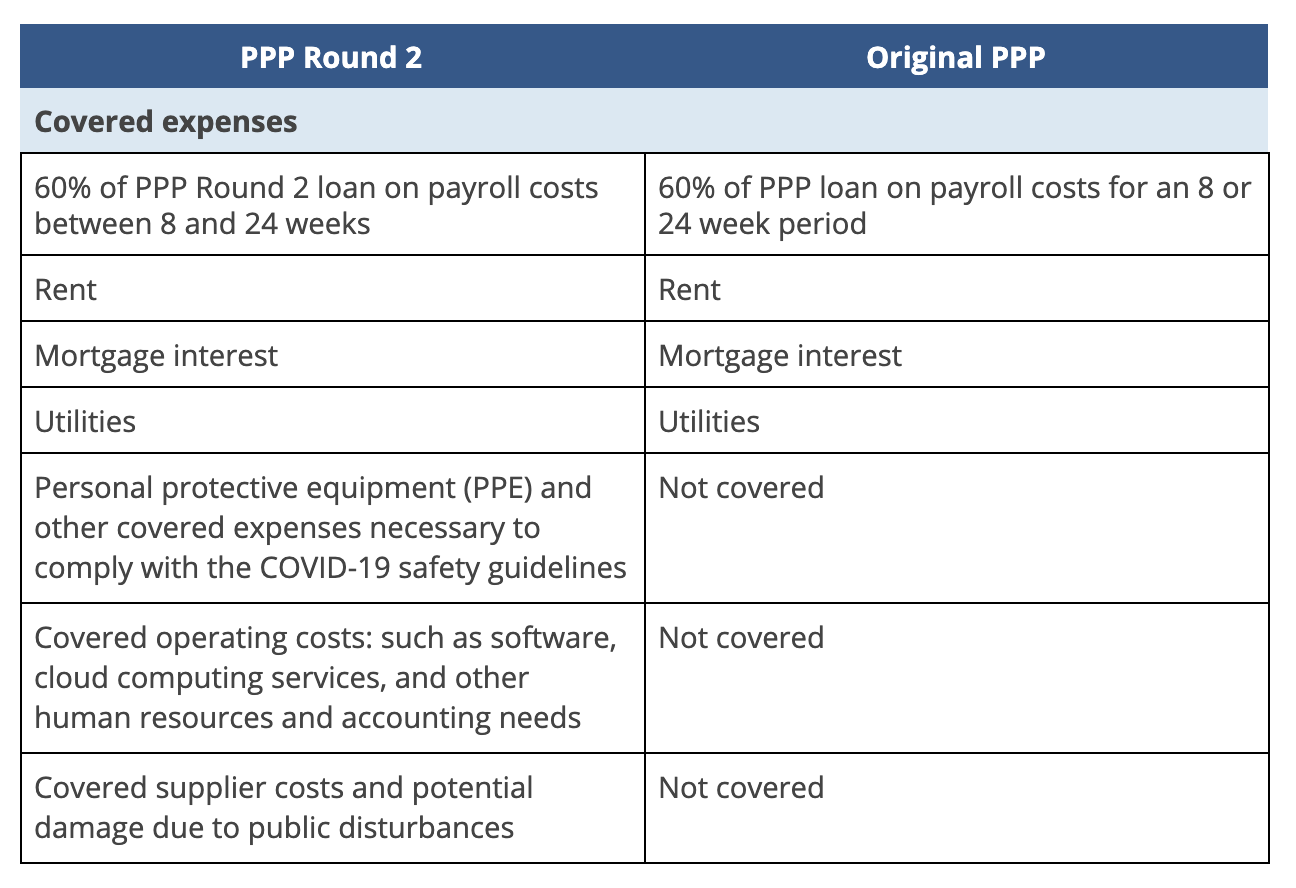

Eligible expenses have expanded under PPP Round 2. The difference in covered expenses between the Round 2 and original PPP loans are as follows:

Accounting for PPP Loans

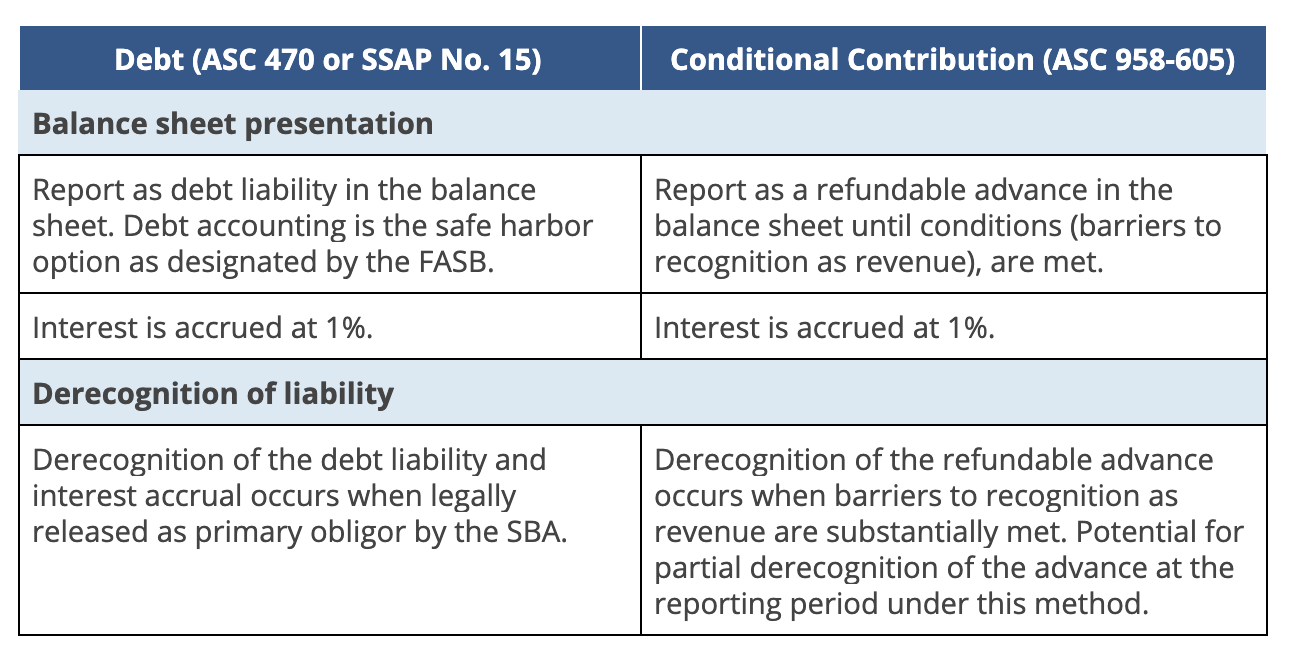

The two accounting options available for GAAP reporting entities are to present the loans as debt under ASC 470 or as a conditional contribution under ASC 958-605 (nonprofit accounting). Statutory reporting entities may only account for the loans as debt under SSAP No. 15. A comparison of the two accounting models is summarized below.

If you have any questions about PPP loans please contact our team.

This communication is intended to provide general information on COVID-19-related measures as of the date of this communication and may reference information from reputable sources. Although our firm has made every reasonable effort to ensure that the information provided is accurate, we make no warranties, expressed or implied, on the information provided. As COVID-19-related efforts are still ongoing, we expect that there may be additional guidance and clarification from regulators that may modify some of the provisions in this communication. Some of those modifications may be significant. As such, be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed.