February 13, 2025

IRS Releases 2024 Loss Reserve Discount Factors

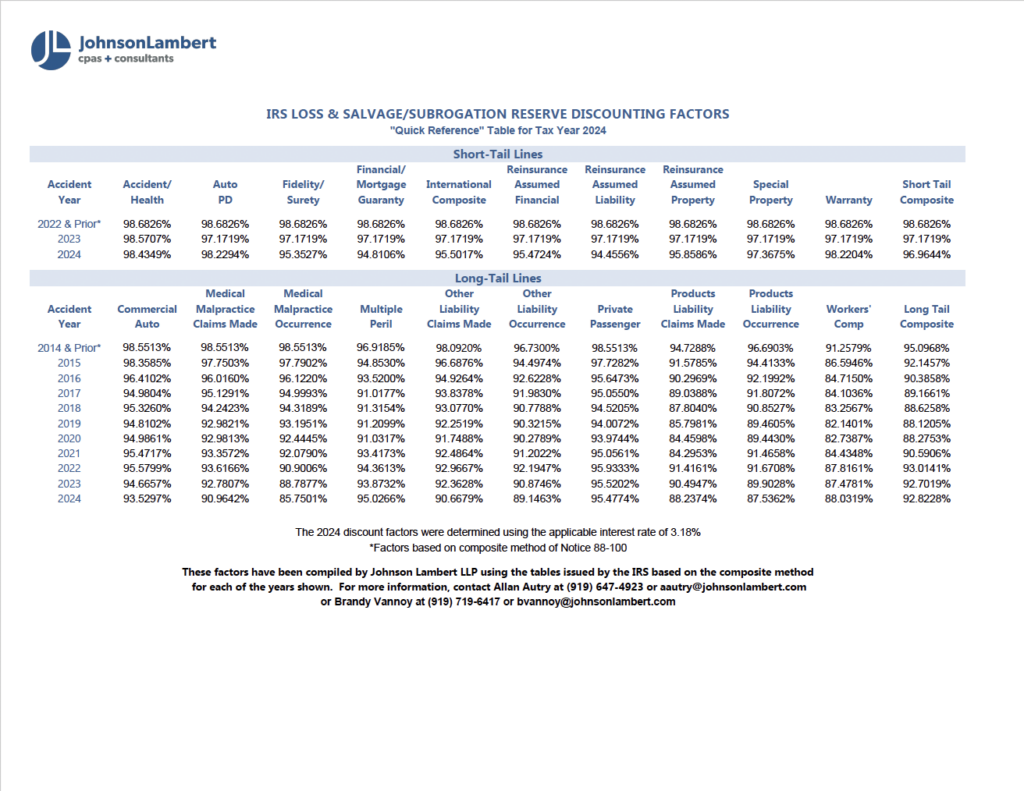

The Internal Revenue Service (IRS) issued Rev. Proc. 2025-15 on February 13, 2025, which contains the new property and casualty discount factors for the 2024 tax year. These factors were determined using the applicable interest rate of 3.18% for 2024 based on the composite method of Notice 88-100.

Linked in this article is a table that summarizes the new factors to use for computing discounted unpaid losses and estimated salvage and subrogation as prescribed for the 2024 tax year.

If you have any questions please contact Allan Autry or Brandy Vannoy.